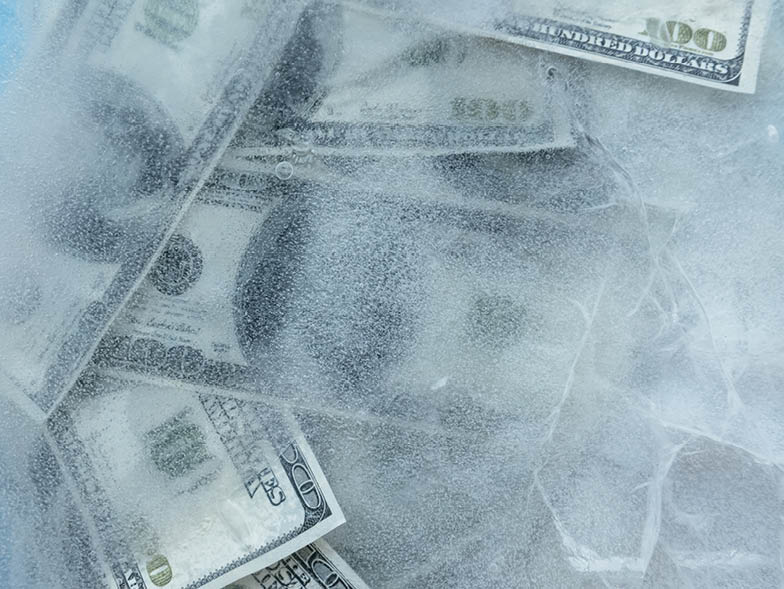

The thought of putting thousands of dollars into a down payment for a home might bring out a lot of emotions: fear, dread, anxiety. Does any of that ring a bell?

Saving for a down payment is no easy task, but it is totally achievable with the right mindset and strategy. Implement some of these tips into your budget, and you’re guaranteed to see a steady uptick in your savings—enough to finally get the home you’ve been dreaming of.

Know where you stand

First things first, take a realistic look at your finances with your mortgage lender to determine what type of loan you qualify for and exactly how much money you’ll need to put down. This can give you a more accurate picture of the time frame you’ll have to hit your savings goals.

Automate your savings (and don’t touch them)

By contributing to an automated savings account weekly, monthly, bi-monthly, etc., you are making the process of saving quite literally, a no brainer. When some of your money is instantly transferred into your savings account without having to remember to do it (or not do it) yourself, you’re much more likely to save and refrain from dipping into the account unnecessarily.

Expect the unexpected

Life happens, and during the process of saving you are bound to run into a few bumps in the road—that’s OK. As long as you are prepared to make up the difference along the line, there’s no reason to let these snags ruin your chances at your new house.

Avoid unnecessary expenses

We don’t need to tell you that daily coffee runs add up over time. Five dollars might not seem like a lot of money, but over the course of a week and a month, that adds up to a significant portion of your spending. Think critically about expenses you can realistically do without for the time being, and seriously consider phasing them out of your budget.

Reevaluate your credit and credit cards

If you have a credit card you use regularly with a significant interest rate, this could put a major stop to your savings. Try to pay off these cards as quickly and efficiently as possible so that they don’t negatively impact your credit or ability to save long-term.

Comments